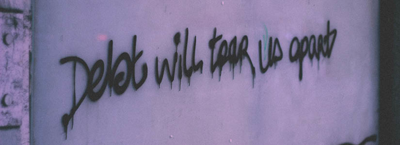

Trying to get out of debt can take a huge toll on your mental health. With the economy the way it is, if you are dealing with multiple debts at the same time, you may feel like there’s no way out.

With Salad Money’s More Than Your Score loans, we’re here to tell you that there is, and will always be, another option.

When it comes to debt, juggling lenders can be incredibly stressful and evidently hard to manage. That’s when you might need to consider debt consolidation.

What is debt consolidation, you ask? Well, that is exactly what we’re going to tell you about today.

In this article, we will explore what debt consolidation loans are, how they work and whether or not they’re a good idea for you.

What Is Debt Consolidation?

As the name suggests, debt consolidation is a way to consolidate debt into a single payment. The practice is widely followed by people across the world to manage debt better and more efficiently.

Simply put, a debt consolidation loan is a larger loan that helps you pay off all your debts at once. This way you’re only dealing with one lender and one monthly loan repayment.

Debt consolidation loans are often taken by people who find themselves dealing with various types of debt and are having trouble managing them.

This can lead to plenty of benefits to a person burdened with severe debt, some of which we are going to discuss in the next segment of this article.

If you’ve debts that have been piling up to £2,000, a simple Salad Money loan can help you consolidate all of it.

What’s more, you don’t have to stress about your credit score. With our unique affordability assessment method, you can qualify for our more than your score loans, without your credit score being used in the initial lending decision.

Why Debt Consolidation Is a Good Idea

Now that you know what debt consolidation is, you’re probably considering it. However, for those of you who are still a little unsure about the idea, we are going to discuss why it might be a good idea for you.

1. Simplifies Your Debt

One of the greatest benefits of taking out a debt consolidation loan is the fact that it largely simplifies your debt for you.

Let’s say you’re dealing with some outstanding credit card debt that you can’t afford anymore and a few payday loans that are eating up your monthly income.

Now managing and repaying these high-interest loans separately can be a very confusing and tiresome task. This can be even more troublesome if you have borrowed from more than three or four lenders.

In this case, a debt consolidation loan can really help you streamline your monthly repayments and essentially simplify your debt.

2. Saves You Money

When you are making monthly repayments of four or five different loans, each one with an interest rate higher than the next, you end up paying a whole lot more than you should.

With the help of debt consolidation, you can pay off all your loans and consolidate debt into one simple, low-interest monthly repayment.

While these loans may seem to charge a higher interest rate than other personal loans, when weighed against your cumulative debt interests, it’s usually much lower.

Choose Salad Money for The Best Personal Loans

Now that you know all about debt consolidation, it’s time you use the idea to manage your finances in a better way.

Moreover, if you find yourself stuck in a loop of endless debt repayments or require some emergency money now, we are here for you.

Applying for one of our new loans doesn’t impact your credit score. We use Open Banking in our initial assessment. If successful, we report your loan to the CRA’s (Credit Reference Agencies). Your credit score won’t hold you back from being eligible.

To learn more about our loans, visit our homepage or call us now!