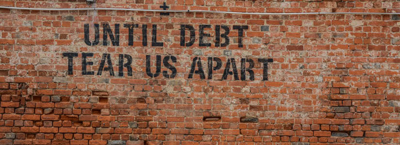

Debt problems are a serious matter that not only affect a person’s financial condition but also mental health, relationships and life.

While many people with a lack of debt management strategy have a debt problem, many are unaware of it.

However, to work on a problem, the first step is to realise that you have one and that is what we are here for today.

In this article, we'll help you spot the early debt warning signs that indicate you might have a problem that you need to work on.

Disclaimer: These are general signs that do not apply to everyone. If you feel that they apply to you and that you do have debt problems, we suggest that you get in touch with an expert to help you.

You’re Making Minimum Payments

While minimum payments are a brilliant concept for banks, they’re not as convenient and flexible as a customer thinks they are.

Minimum payments are designed in a way that keeps you in debt for a longer period of time and also helps them obtain greater interest.

If you’re making these payments, we suggest you begin setting aside some extra money and pay off more than the minimum requirement.

If you can’t, however, you probably have debt problems. You could try to get a side job and find ways to generate some passive income to get out of debt soon.

Your Minimum Payments Are a Huge Part of Your Expenses

While you might be making payments for all your debts, if the sum of all your minimum payments is a large part of your monthly income, it’s not good.

Debt management includes various strategies that help us maintain our monthly expenses in a way that the debt itself does not affect our personal life.

However, if a large sum of your monthly expenses goes towards your debt, it affects your personal expenses and you may need some help to manage debt.

A simple rule of thumb to evaluate whether your minimum repayments are a help or a hindrance is to keep the total below 20% of your monthly income. If the repayments are above that you could create a well-prepared debt plan.

You Are Denied Loans

The next warning sign is pretty obvious. Credit denial usually happens when the lender evaluates your creditworthiness and is disappointed.

In other words, if you’re trying to get a debt consolidation loan or a credit card for yourself, and you’re denied. It pretty much says that you have some severe debt problems.

What can you do about it? Work on your credit history and find ways to improve your credit score. We understand that it’s not as simple as it sounds.

Therefore, we suggest you try these simple tips or opt for our fair loans that aren’t based on your credit score.

You Don’t Have Any Savings

One of the biggest indicators of debt problems is the fact that you do not have a provision for savings in your monthly budget.

Savings in the form of emergency funds, retirement savings, and so on are an essential part of financial management and planning.

If your monthly debt payments and expenses are higher or equal to your monthly income, it is evident that you need a proper debt plan.

You can use your current savings to manage debt to a certain extent. However, we advise you to seek professional help if you find yourself all out of savings and still have a ton of debt.

Get Fair Loans With Salad Money

Applying for one of our new loans doesn’t impact your credit score. We use Open Banking in our initial assessment. If successful, we report your loan to the CRA’s (Credit Reference Agencies). Your credit score won’t hold you back from being eligible.

To learn more about our service and see if its correct for you, contact us now!